Discover Your Cash Gap Needs Faster and Easier

If you’ve ever tried to prepare funding numbers in a spreadsheet, you know it can be overwhelming—messy formulas, incomplete data, and a lot of second guessing. The Cash Gap Evaluator from SMB FinTools makes it simple. With just a few inputs, you ll see exactly how much funding your project needs, how profitable it could be, and how to present your case with confidence.

Possible Use Cases

Workplace Move or Renovation

Plan relocation or remodel with clear funding.

Technology Upgrade

Budget for new software, hardware, or systems.

New Employee(s)

Cover hiring, training, and payroll with confidence.

Additional Service Lines

Launch new offerings with precise cost planning.

Large Equipment Purchase

Calculate the loan you need for machinery or tools.

Extra Business Location

Expand knowing your full investment needs.

Struggling to Secure Business Funding?

Many small business owners face challenges when approaching financing sources, such as banks or investors, for funding:

- Disorganized financial data that can lead to poor first impressions.

- Uncertain project profitability leads to moving forward with projects set to fail.

- Difficulty determining the exact loan amount required.

- Failure to explain the details of their financial projections due to incomplete

calculations.

Without clear and professional financial projections, the opportunities for growth could slip away.

The Solution

This financial software transforms the way you analyze new projects and prepare for funding discussions. By combining powerful tools with a user friendly interface, it will put you in the best position to secure the funding your business needs to thrive.

The Solution

This financial software transforms the way you analyze new projects and prepare for funding discussions. By combining powerful tools with a user friendly interface, it will put you in the best position to secure the funding your business needs to thrive.

Why Choose This Financial Tool

From the moment you sign in, the Cash Gap Evaluator walks you through each step of calculating your project funding needs. No complicated spreadsheets.

No second guessing your numbers. Just a clear, guided path from data entry to decision making.

Prepare Like a Pro

Organize your data easily and present professional, polished reports at every meeting.

Accurate Cash Flow Projections

View current and future cash flow clearly, with full visibility into your project s impact.

Get the Right Loan Amount

Know exactly how much funding to request—no guesswork.

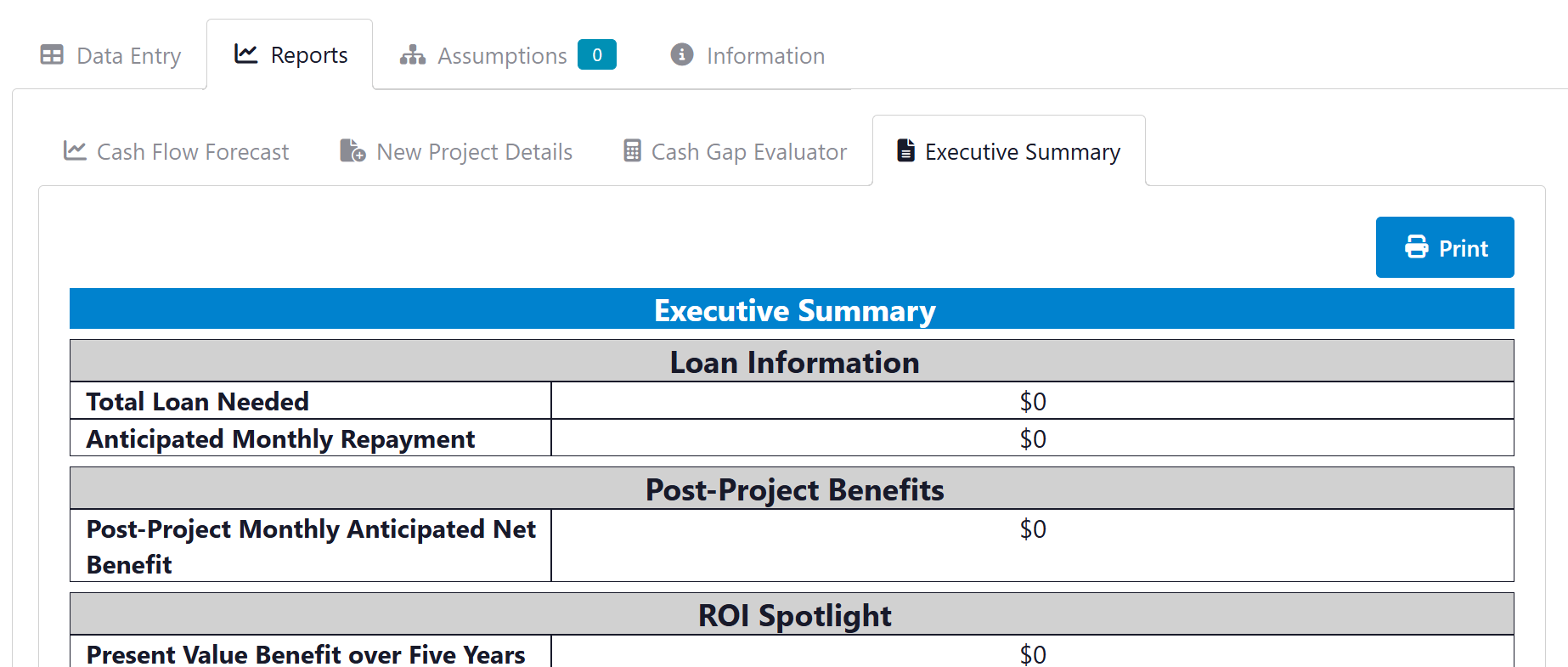

Highlight Profitability

Show key metrics that strengthen your growth story.

Spot Potential Weaknesses

Identify and address issues before they derail your funding conversations.

How It Works

Get from messy numbers to clear funding needs in five simple steps.

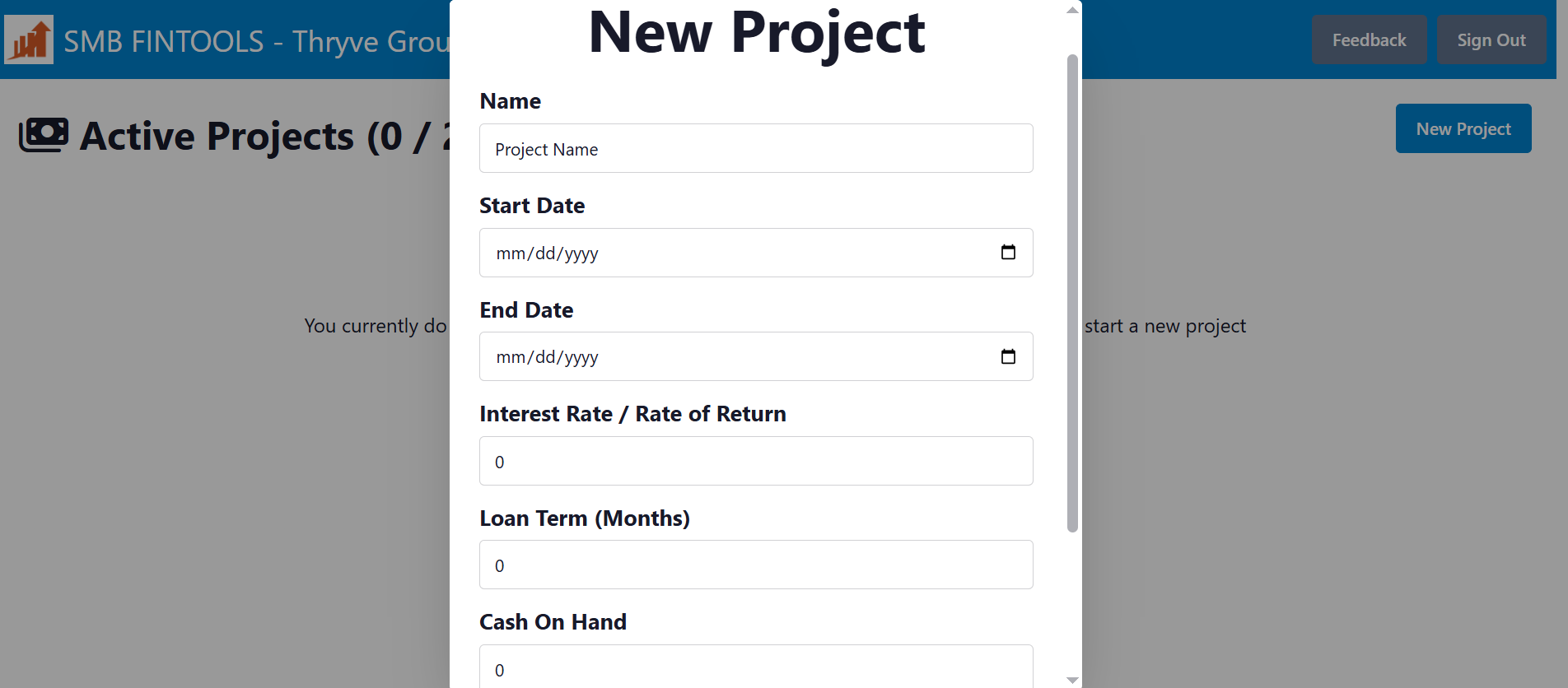

Easy to Get Started

Simply start a New Project to begin using the software.

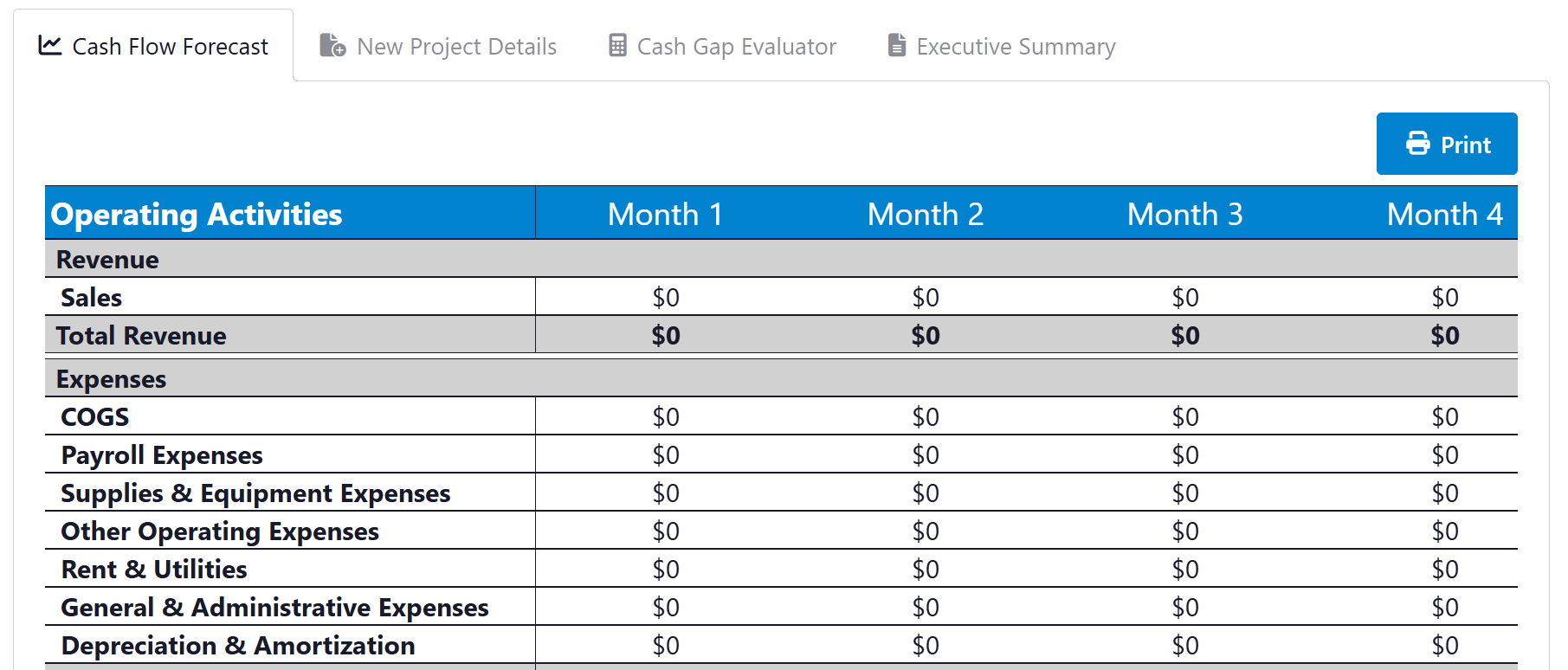

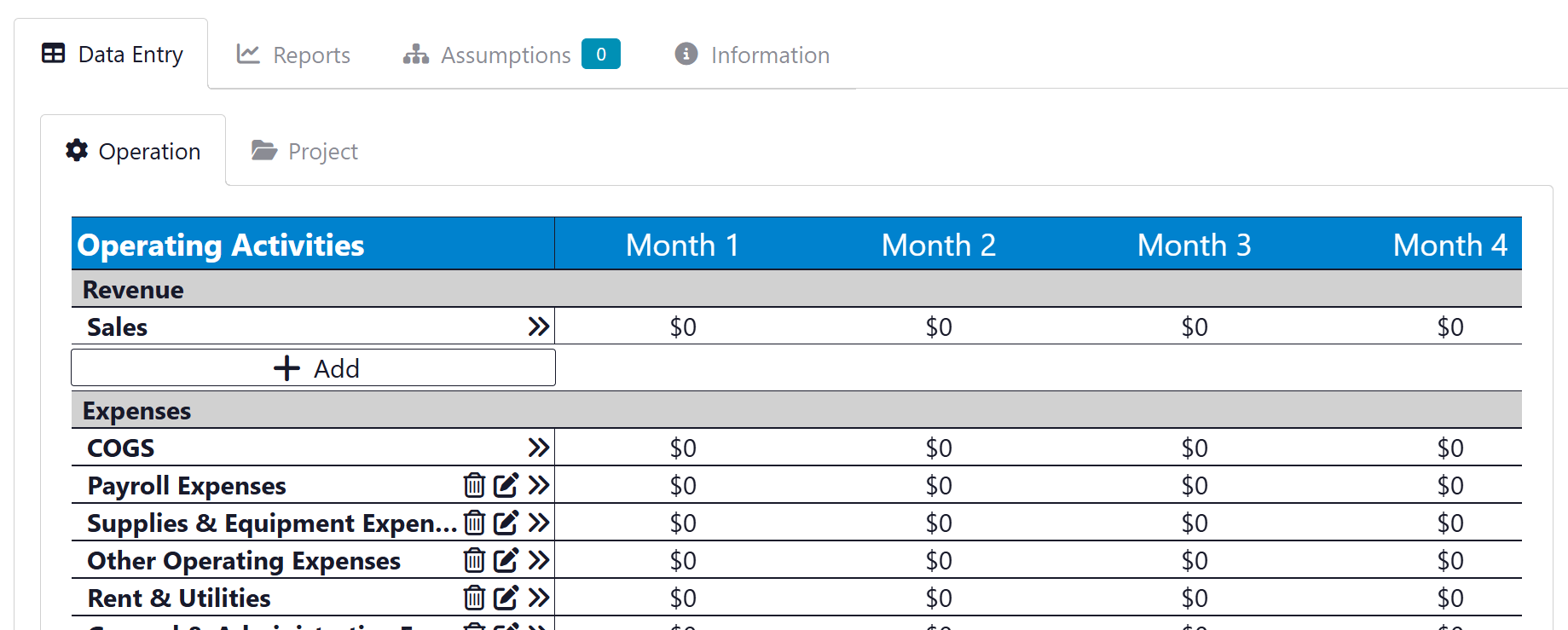

Project and Analyze Cash Flow

Input your financial data into our intuitive platform for seamless organization. Then, use the software to create detailed cash flow projections for your current operations and future projects.

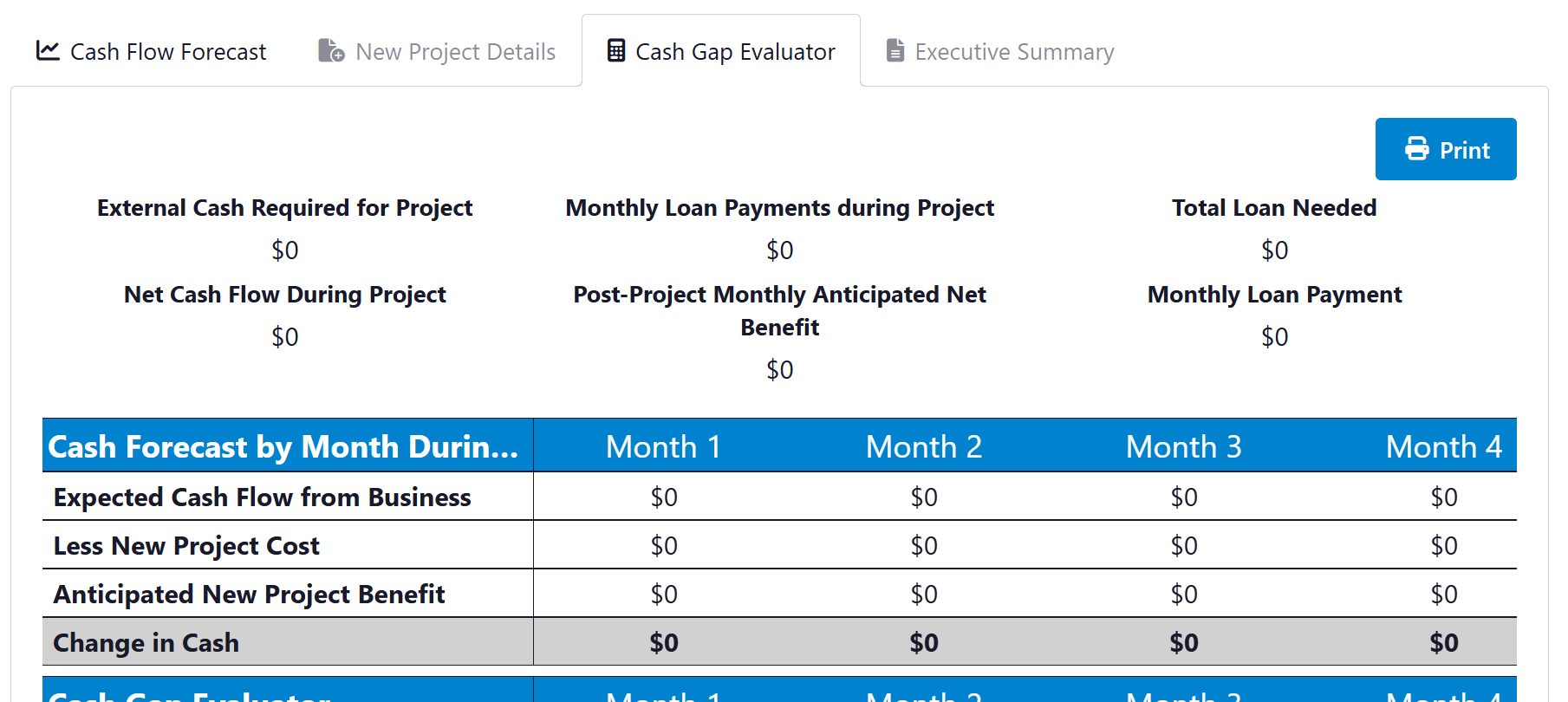

Evaluate Your Cash Gap Needs

Assess whether you will need to raise money to complete the project or your business can finance itself. Pinpoint the expected cash funding gap that needs to be filled.

Project Profitability

Review whether the project will be profitable under your current plan.

Fine-Tune Your Numbers

Refine your projections based on multiple “what-if” scenarios.

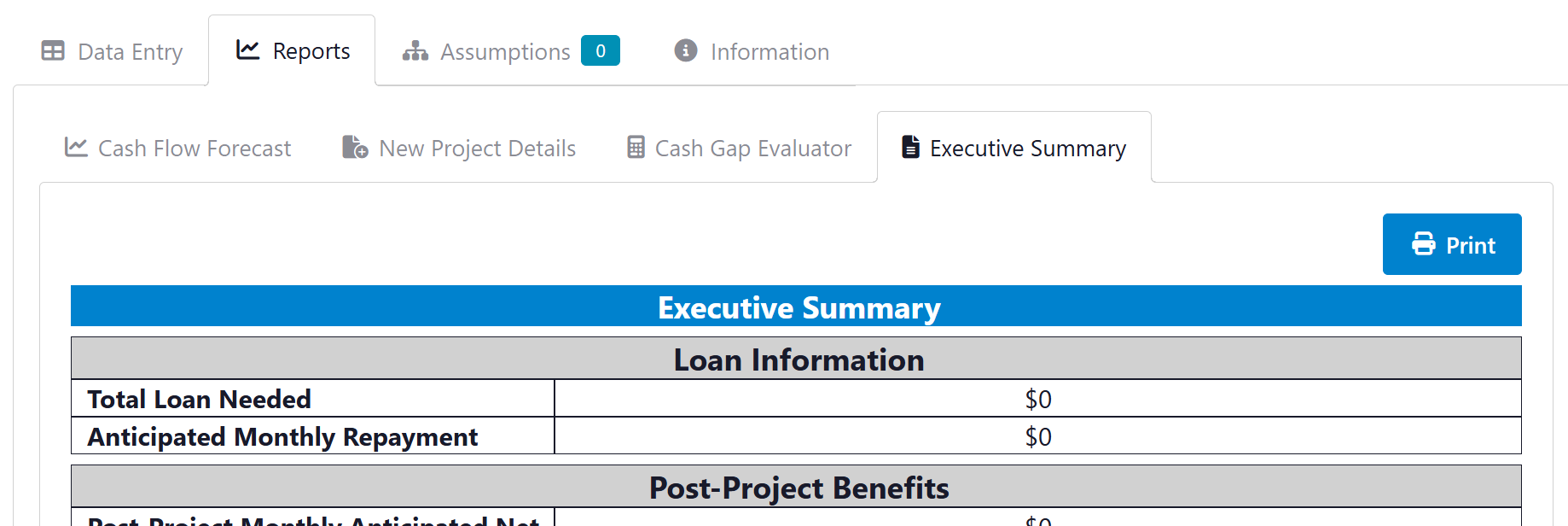

Generate Professional Reports

Download polished PDF reports to present to your management team, banks or investors, helping you make your best impression.